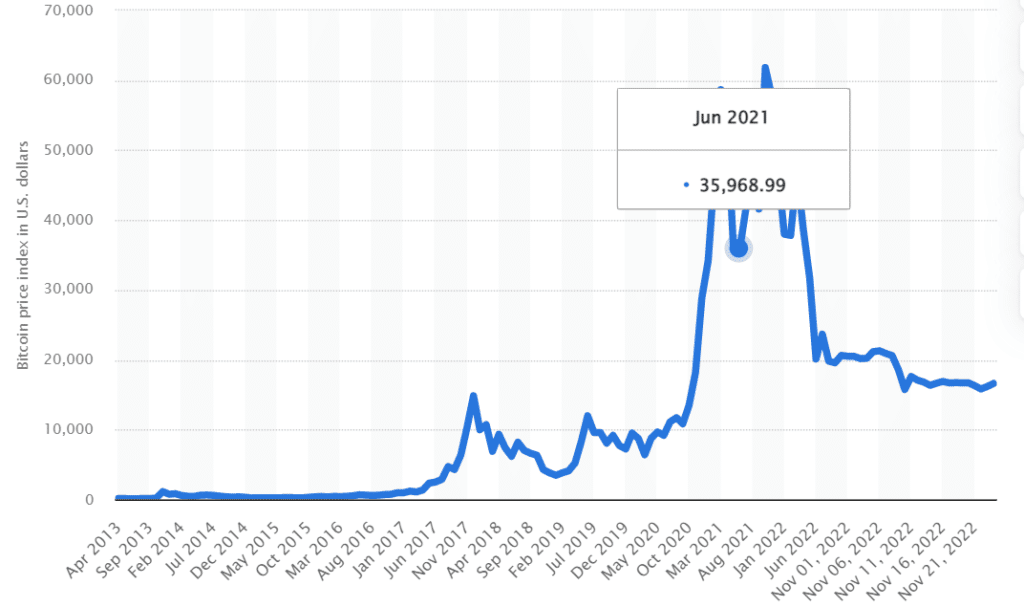

Most cryptocurrency users will agree that the market experiences turbulence during some seasons. Even the most popular coins can experience a dramatic downward fall. An example is Bitcoin and Ethereum, whose value fell over 50% in the first half of 2022 from its all-time high in the last quarter of 2021. The chart below from Statista shows Bitcoin’s price index from April 2013 to November 21st 2022.

Some experts are scared that it might mean the crypto market may end up stalling, and prices could even reduce further before any significant recovery. All the same, crypto remains a hot topic not only for investors but also in popular culture. While it’s difficult to predict where things are headed, professionals are following things like institutional adoption and regulations to get a better sense of the market. Here are a few predictions on what industry experts think about the future of crypto.

The Currency Will Continue Attracting More Users

Even though crypto experiences significant highs and lows, its popularity does not seem to waiver. There’s a possibility that more people will still want to use it. For instance, more retail outlets and gaming websites like Verde Casino are more likely to introduce crypto as one of their banking methods. More consumers are embracing crypto because it offers straightforward and affordable transactions. Cryptocurrency also gives users privacy, is relatively secure, and the currency is accessible to everyone because all a person needs is an internet connection and a smartphone or PC to get their hands on the currency. Setting up a cryptocurrency wallet is usually fast when you compare the process to opening accounts in traditional financial situations.

Cryptocurrency Can Be the Future of Money

There’s a chance that more national governments may agree to a common stance toward using crypto. Some nations like Indonesia and China have banned the use of crypto in their territories. On the flip side, The Central African Republic and El Salvador have already proclaimed Bitcoin as an official currency.

Governments also realize the importance of regulating crypto even though that’s not how the industry works. The United States is putting in the effort to control cryptocurrency. Experienced and highly competent experts were put in charge of the niche. They aim to create an efficient and fair legal framework and put a taxation system in place. America seeks to build something equally beneficial to all participants, be it crypto businesses, banking institutions, consumers, or investors. In the future, there is a probability other countries will borrow some of the best practices from the U.S.

Blockchain Might Be Used to Leverage a Majority of World Trade

Blockchain can potentially offer significant business value to the global supply chain business. The world trade industry is currently married with fraud, inefficiencies, and errors from untrusted partners. Some of the problems blockchain can solve include the following:

- Imitation medicines

- Counterfeit auto parts

- Adulteration in the food supply chain

- Sham electronic equipment, including medical devices

Traders can attest to the fact that supply chain issues are life-threatening. It is primarily because the business ecosystems are partially automated, fragmented, and lack trusted central authority to certify the authenticity and track provenance. Blockchain is a technology that can bring about anti-disruption, introduce order and act as a unification force. It can also enhance flexibility, performance, maturity, and efficiency.

More Cryptocurrency Innovations

Innovations have been one of the key growth drivers in the crypto market. There is a possibility that this will probably not stop anytime soon. CoinMarketCap reveals more than seven thousand cryptocurrencies on its website alone. The DeFi movement, or Decentralized Finance, is another innovation taking over the world by storm. This is an umbrella term for financial services found on public blockchains. DeFi is a global peer-to-peer pseudonymous avenue that’s open to everyone. It has grown over $100 billion in contract value after it took over some conventional financial services. Examples of decentralized Finances are:

- Compound that facilitates peer-to-peer lending.

- dYdX that supports derivative markets.

- Uniswap provides a decentralized exchange.

- Tornado Cash simplifies payments.

The above companies and many more have come in to eliminate the need for centralized authorities and intermediaries while allowing crypt holders to generate yields. Additionally, non-fungible tokens or NFTs have opened up broader markets. NonFungible reports that in October 2021 alone, sales were worth over 1.2 million. Even though most of the transactions consist of art or games, the same tech could revolutionize real estate and other transactions representing intellectual or physical property.

Closing Remarks

It’s impossible to tell for sure what the crypto market’s future will be in 2023 and beyond, seeing that it has always been volatile in terms of public perception and price. The topic is bound to have more questions than answers. Above are a few predictions that may or may not happen because we can only wait and see.