In the transformative world of financial services, open banking has emerged as a cornerstone for innovation, enabling a spectrum of monetization strategies that banks and fintech are adeptly navigating.

This paradigm shift has fostered greater financial clarity and customer empowerment and has also unveiled new opportunities for creating value and generating revenue.

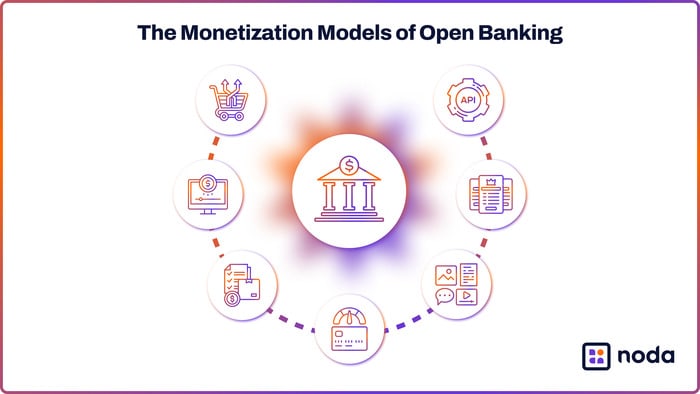

The Monetization Models of Open Banking

Premium APIs

Banks are tapping into the potential of open banking by offering Premium APIs, which provide advanced functionalities beyond basic data sharing. These APIs can deliver enriched data services such as detailed analytics, which third-party providers can access for a fee, paving the way for a lucrative revenue channel.

Subscription Services

Leveraging access to financial data, fintechs are crafting subscription-based models that offer customers bespoke financial services. These range from advanced budgeting tools to automated savings and investments, all harnessing the sharing of data provided by open banking.

Referral and Affiliate Marketing

Referral and affiliate marketing programs stand out as a strategic intersection where banks and fintechs can profit from commission-based referrals. They can create a network that fosters revenue growth and customer retention by recommending each other’s services.

Advanced Credit Scoring

The comprehensive financial data available through open banking can revolutionize credit scoring. By providing a more sophisticated analysis of a customer’s economic behavior, fintechs can offer this enhanced credit scoring service to banks, which can be a game-changer in risk assessment and lending.

Tailored Financial Products

Open banking is the catalyst for a new era of personalized financial products. Banks can now devise financial solutions that are as unique as each customer’s financial footprint, from customized loans to credit cards with personalized rewards schemes.

Data Monetisation

The copious data traversing open banking systems is a gold mine for banks and fintechs. This data can be analyzed and transformed into actionable insights, which can be sold to businesses seeking to refine their market strategies.

Targeted Cross-Selling

With a detailed understanding of customer finances, banks and fintechs can engage in targeted cross-selling. This strategy optimizes the customer experience by providing relevant offers, thus improving engagement and sales.

The Perspective of a Fintech Leader

Amidst these emerging monetisation strategies, Michael Bystrov, the Chief Revenue Officer at a leading fintech company, Noda, shared a keen insight:

“Open banking is not just a regulatory mandate; it’s an opportunity to rethink how we create value for our customers. It enables us to transform data into personalized services that meet and anticipate customer needs.”

The future of finance is collaborative, and open banking is where this partnership between banks and fintechs thrives. As they continue to explore innovative monetization models, the ultimate winner is the customer, who enjoys more tailored, insightful, and secure financial services. It’s an exciting time for the financial industry as it leverages open banking to build profits and more robust, more informed relationships with customers.