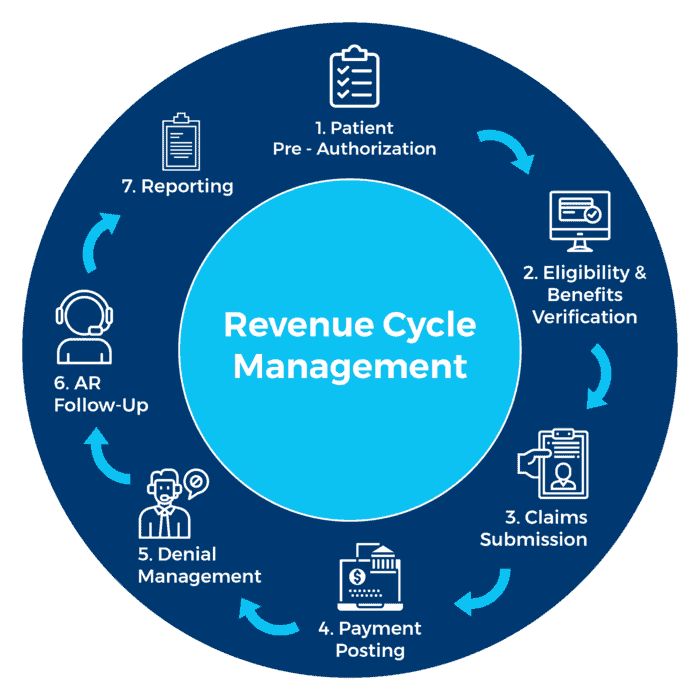

Hospital revenue management has a whole lot of steps for proper tracking of patients and their final payment. In simple words, this process is referred to as revenue cycle management. It is a financial process that tracks a patient’s revenue from the very first consultation to the final balance payment. Following these steps is crucial to boost revenue and improve patient satisfaction in the best way possible. Thus, in this guide, we have covered all the details regarding the steps involved in smooth hospital management. So, without any further ado, let’s get started!

13 Crucial Steps for Effective Revenue Cycle Management

When crafting a strategic plan for hospital revenue cycle management, it is vital to have streamlined processes. This guide will share all of them in detail below.

Step 1: Patient Pre-Registration

In this first step, all the patient information is collected for scheduling an appointment. It includes filling the online/offline forms with accurate information. It is also crucial to verify the patient’s insurance coverage. The hospital needs to maintain strict patient data confidentiality as per HIPAA compliance.

Step 2: Real-time Insurance Verification

This step involves proper insurance checks with proper documentation and verification records. In case of any issues, the patients and family must be educated about the insurance responsibilities and resolve any discrepancies quickly. Also, all the current updates on the patient’s insurance are shared for recurring patients.

Step 3: Full Patient Registration

This is the third step that covers the patient’s consent documentation for treatment. Also, all the identity verification measures take place for accurate data entry and security. Also, all the patient information is verified and updated on a daily basis.

Step 4: Efficient Charge Capture

This step ensures the recording of all charges on a timely basis to never miss any revenue opportunity. Proper auditing trails are tracked and maintained with verified entries. All the healthcare staff is trained in different charge capture procedures and rectifying discrepancies.

Step 5: Clean Claim Submission

This step requires accuracy in all patient records for proper submission of claims. Electronic submission is used for quick processing so documentation integrity must stay intact. Also, a proper system must be established for easy tracking and denied claim re-submissions.

Step 6: Claim Adjudication

This process revolves around insurance companies completing their formalities regarding claim approval. Thus, the management needs to keep an eye on each claim status and investigate any denials with streamlined appeals. Also, continuous staff training on dispute resolution and policy changes must be incorporated.

Step 7: Prompt Patient Payment Posting

In this step, automated texts and alerts about payment postings are shared with insurance companies, family members, or third-party companies to prevent payment delays. This payment posting is done in a timely manner to avoid discrepancies later. Also, patients get remittance advice for reconciliation and prompt payment retrieval.

Step 8: Robust Denial Management

This step involves proper root cause analysis of denials and addressing them via automated tracking and address systems. Also, all hospital staff should be trained to rectify any claim errors and make focused efforts on retrieving claims.

Step 9: Accounts Follow-up on Receivables

In this step, the accounts team tracks all the overdue accounts and prioritizes aged accounts. This is done via persistent communication and also, through regular alerts and reminders for quick resolution.

Step 10: Statement Processing of Patients

The management ensures that all statements are easily understandable and delivers all of them quickly after adjudication of insurance. The patient gets proper support on billing and insurance-related queries.

Step 11: Payment Collection From Patients

After the full treatment, patients are provided with complete price transparency about different plans and payment modes available for convenience. On receiving the payment, proper payment receipts and transaction documentation are done.

Step 12: Regular Revenue Reporting and Analysis

This step holds a prominent place in RCM owing to its significant insights that will highlight growth insights. From regular analysis and tracking of KPIs and gathering of financial reports for benchmarking, the final reports are obtained for reliable and consistent data integrity.

Step 13: Auditing and Compliance

Regular reviewing of different RCM processes is pivotal to promote growth and identify the loopholes for immediate implementation of remedial actions. Thus, conducting regular external and internal audits, risk assessments, and fostering seamless collaboration can help in staying ahead of excellent hospital management. This step also involves educating and training the staff on updated policies and compliance.

Some Last Words

Implementing effective RCM practices is a necessity to attain huge success in the hospital landscape. For a thriving hospital management business, it is crucial to follow all these revenue cycle management steps shared above. They will not only streamline the entire revenue management cycle but also result in reduced billing errors and higher patient service satisfaction.